NEW YORK, Jan. 31, 2023 /PRNewswire/ — S&P Dow Jones Indices (S&P DJI) today released the latest results for the S&P CoreLogic Case-Shiller Indices, the leading measure of U.S. home prices. Data released today for November 2022 show that home price gains declined across the United States. More than 27 years of history are available for the data series and can be accessed in full by going to https://www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller/.

YEAR-OVER-YEAR

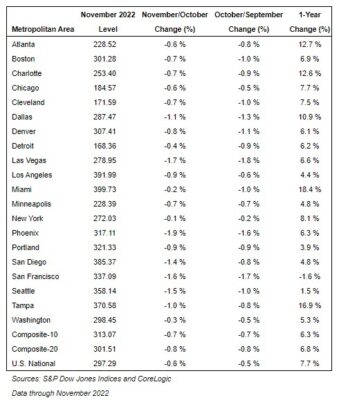

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 7.7% annual gain in November, down from 9.2% in the previous month. The 10-City Composite annual increase came in at 6.3%, down from 8.0% in the previous month. The 20-City Composite posted a 6.8% year-over-year gain, down from 8.6% in the previous month.

Miami, Tampa, and Atlanta reported the highest year-over-year gains among the 20 cities in November. Miami led the way with a 18.4% year-over-year price increase, followed by Tampa in second with a 16.9% increase, and Atlanta in third with a 12.7% increase. All 20 cities reported lower price increases in the year ending November 2022 versus the year ending October 2022.

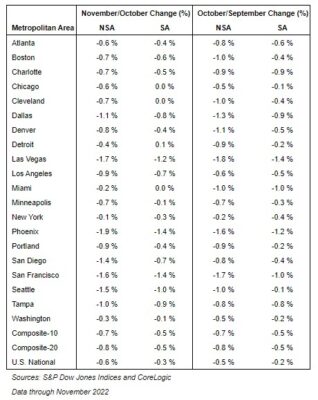

MONTH-OVER-MONTH

Before seasonal adjustment, the U.S. National Index posted a -0.6% month-over-month decrease in November, while the 10-City and 20-City Composites posted decreases of -0.7% and -0.8%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.3%, and the 10-City and 20-City Composites both posted decreases of -0.5%.

In November, all 20 cities reported declines before seasonal adjustments. After seasonal adjustments, 19 cities reported declines, with only Detroit increasing 0.1%.

ANALYSIS

“November 2022 marked the fifth consecutive month of declining home prices in the U.S.,” says Craig J. Lazzara, Managing Director at S&P DJI. “For example, the National Composite Index fell -0.6% for the month, reflecting a -3.6% decline since the market peaked in June 2022. We saw comparable patterns in our 10- and 20-City Composites, both of which stand more than -5.0% below their June peaks. These declines, of course, came after very strong price increases in late 2021 and the first half of 2022. Despite its recent weakness, on a year-over-year basis the National Composite gained 7.7%, which is in the 74th percentile of historical performance levels.

“All 20 cities in our November report showed price declines on a month-over-month basis, with a median decline of -0.8%. Moreover, for all 20 cities, year-over-year gains in November were lower than those of October, with a median year-over-year increase of 6.4%. Interestingly, home prices in San Francisco were down by -1.6% year-over-year, the first negative result for any city since San Francisco’s -0.4% decline in October 2019. This is the worst year-over-year result for San Francisco in more than 10 years (since a -3.0% result in March 2012). West coast weakness was not limited to California, as San Francisco was followed by Seattle (+1.5%) and Portland (+3.9%) at the bottom of the league table.

“In contrast, November’s best-performing cities were clustered in the Southeast. Miami (+18.4%) was the best performer, followed by Tampa (+16.9%). November is the eighth consecutive month that one of our Florida cities has been the national leader. The month’s bronze medal went to Atlanta (+12.7%), narrowly edging out Charlotte (+12.6%). Unsurprisingly, the Southeast (+15.1%) and South (+14.3%) were the strongest regions and the West (+4.0%) was the weakest.

“As the Federal Reserve moves interest rates higher, mortgage financing continues to be a headwind for home prices. Economic weakness, including the possibility of a recession, would also constrain potential buyers. Given these prospects for a challenging macroeconomic environment, home prices may well continue to weaken.”

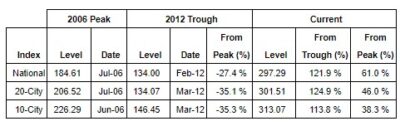

SUPPORTING DATA

Table 1 below shows the housing boom/bust peaks and troughs for the three composites along with the current levels and percentage changes from the peaks and troughs.

Table 2 below summarizes the results for November 2022. The S&P CoreLogic Case-Shiller Indices could be revised for the prior 24 months, based on the receipt of additional source data.

Table 3 below shows a summary of the monthly changes using the seasonally adjusted (SA) and non-seasonally adjusted (NSA) data. Since its launch in early 2006, the S&P CoreLogic Case-Shiller Indices have published, and the markets have followed and reported on, the non-seasonally adjusted data set used in the headline indices. For analytical purposes, S&P Dow Jones Indices publishes a seasonally adjusted data set covered in the headline indices, as well as for the 17 of 20 markets with tiered price indices and the five condo markets that are tracked.